|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pet Insurance Plans for Pre Existing Conditions: Understanding Your OptionsWhen it comes to safeguarding your furry friends, pet insurance can be a vital part of their healthcare plan. However, navigating pet insurance plans for pre-existing conditions can be a bit more complex. This article will explore the nuances of these plans and help you make informed decisions. What Are Pre-Existing Conditions?Pre-existing conditions are health issues that your pet has before you apply for insurance. These can include anything from chronic illnesses like diabetes to past injuries. Understanding how insurers view these conditions is crucial. Types of Pre-Existing Conditions

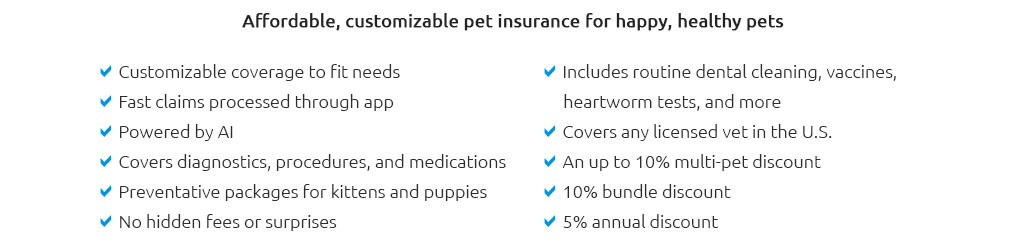

How Insurers Handle Pre-Existing ConditionsMost pet insurance companies exclude pre-existing conditions from their coverage. However, some plans offer limited coverage or exceptions under specific circumstances. Waiting PeriodsInsurance providers often impose waiting periods before coverage begins. During this time, any new symptoms or conditions that arise may also be considered pre-existing. Curable vs. Incurable ConditionsSome insurers differentiate between curable and incurable pre-existing conditions. Curable conditions that have been symptom-free for a certain period might be covered in the future. Choosing the Right PlanIt's essential to compare different insurance plans to find one that suits your pet's specific needs. Consider aspects like the average cost of pet health insurance and potential out-of-pocket expenses.

Cost ImplicationsThe cost of insuring a pet with pre-existing conditions can be higher due to the increased risk. Understanding the average monthly cost for pet insurance can help in budgeting effectively. Budgeting Tips

FAQ SectionCan I get pet insurance if my pet has a pre-existing condition?Yes, you can get pet insurance, but the pre-existing condition will likely not be covered. Some insurers offer coverage for conditions deemed curable if they've been symptom-free for a certain period. Are there any pet insurance companies that cover pre-existing conditions?Most companies do not cover pre-existing conditions, but some may offer limited coverage for curable conditions or provide wellness plans that cover routine care, which can help manage overall expenses. How can I manage costs if my pet has a pre-existing condition?Consider a mix of savings, wellness plans, and careful budgeting to cover veterinary care. Consulting with your vet about cost-effective treatment plans can also help manage expenses. https://www.forbes.com/advisor/pet-insurance/pet-pre-existing-conditions/

A pet insurance pre-existing condition is an injury or illness that your pet had before your coverage began. You can generally break pet pre- ... https://money.com/best-pet-insurance-for-pre-existing-conditions/

Most pet insurance companies don't cover pre-existing conditions. However, some of the best pet insurance companies cover future occurrences of ... https://www.cnbc.com/select/best-pet-insurance-pre-existing-conditions/

Best pet insurance for pre-existing conditions - Best for affordability: Figo - Best for older pets: Pets Best - Best for high reimbursement rate: Pumpkin - Best ...

|